- As the huge and synchronised shock to economic activity from Covid-19 was met with an equally vast and synchronous policy response, we, as most others, marked sharply lower our expectations for economic and corporate earnings growth in 2020.

- Three developments have since tilted the balance once more, this time in favour of select cyclicality within a more neutral risk budget: a relatively favourable US election outcome; a far greater number of meaningfully more efficacious vaccines for Covid-19 than expected; and shallower 2020 contractions than feared, which has led to more V-shaped forecasts for economic and earnings growth.

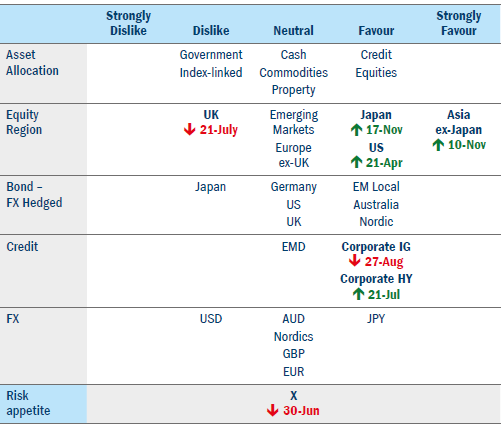

- Our focus has been on building exposures in Japanese and emerging Asian equities, held together with US equities. We also continue to like credit markets, but as spreads have normalised we are adding our incremental pound or dollar to higher-yielding credit that should also benefit from the better cyclical picture, in addition to continued ultra-easy policy. These are areas where we expect the best risk-adjusted returns to come from over the next 12-18 months.

- Columbia Threadneedle’s central forecasts are for a ceiling of 2% on 30-year US yields, and 1% for 10-year yields, which should create fertile conditions for more persistent risk rallies.

Both financial markets, and us, have come a long way since the dark days of spring to the (unseasonally) brighter days of winter. Back in March, as the huge and synchronised shock to economic activity from Covid-191 was met with an equally vast and synchronous policy response, we, as most others, marked sharply lower our expectations for economic and corporate earnings growth in 2020.

Our focus has been on building exposures in Japanese and emerging Asian equities, held together with US equities. We also continue to like credit markets

Our central forecasts are for a ceiling of 2% on 30-year US yields, and 1% for 10-year yields, which should create fertile conditions for more persistent risk rallies

Figure 1: Asset allocation snapshot with key recent changes highlighted