In a rare inter-meeting policy move on 3 March, the Federal Reserve Board Open Market Committee (FOMC) announced a 50 basis point rate cut in the Federal funds rate in an effort to mitigate the economic and market impacts of the novel coronavirus. Based on the Fed funds futures curve, many investors had estimated around three 25 basis point cuts in 2020 prior to the announcement, but the timing of the policy announcement caught the market by surprise.

Speaking after the meeting, Fed Chair Jerome Powell stated that the cut would “provide a meaningful boost to the economy … and avoid a tightening of financial conditions”.

Lowering interest rates can be a powerful tool for combating deteriorating financial conditions. Because companies borrow at both floating and fixed rates, a reduction in borrowing costs can provide meaningful support for wages and employment, as well as for a company’s spending plans, if the economy slows down as now anticipated. For consumers, lower borrowing rates can be an incentive to refinance mortgages and lower their total debt expense, which can put real money in their pockets.

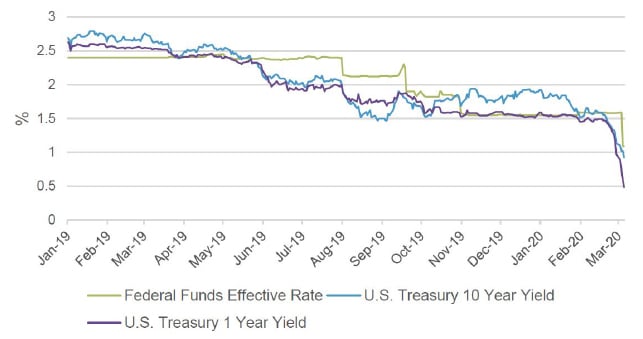

Historically, yields on US government bonds have directionally tracked the Fed funds rate (many factors move yields) and since news of the coronavirus broke in January, yields on government bonds at all maturities have moved significantly lower. The yield on the 10-year US Treasury reached an all-time low on 9 March and certain yield curve pairs are now inverted, indicating that the market expects further easing and a return to a zero percent Fed funds rate.

So, where do we go from here? In our view, odds are rising that the Fed will have to ease again to offset a further tightening in global financial conditions. Historically, every time the FOMC has lowered rates between scheduled meetings, it lowered rates again at the regularly scheduled meeting that followed.

This would suggest that Fed funds will move another 25-50 basis points lower in a couple of weeks. A zero percent Fed funds rate makes the risk/reward in the front end of the yield curve less attractive, and once the rate hits zero we would expect the Fed’s next move (if the markets do not begin to show improvement) would be unconventional measures, such as asset purchases.

Figure 1: US Fed funds rate and yields

Source: Macrobond and Columbia Threadneedle Investments. The effective Federal funds rate is a volume-weighted median of overnight Federal funds transactions, published daily by the New York Fed.

In our view, a sustainable move higher in US yields will require a combination of data that indicate limited economic damage from the virus and aggressive fiscal stimulus in conjunction with rate cuts. There are limits to what central banks can do, and the market is looking for, and responding to, policy responses by governments as well as central banks.