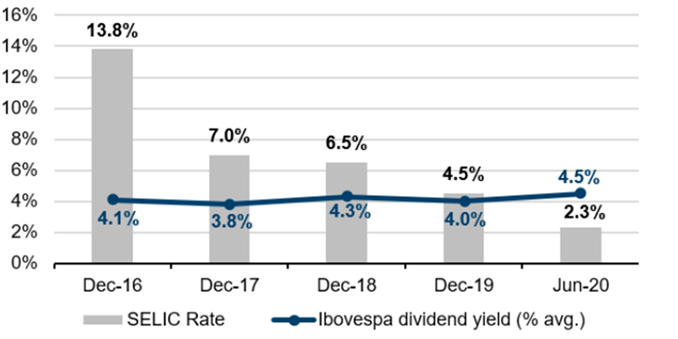

It is true that there is often no free lunch in investing, meaning that high returns often come with high risk. But over the past few decades, Brazilian investors have had the luxury of a free lunch by earning attractive returns on bank deposits with very little risk. Interest rates have averaged 10% over the past 10 years, with the SELIC (Brazilian interest rate) at 14.25% as recently as 2016.

Source: XP Inc. Institutional Presentation, as of 31 May 2020. SELIC (Sistema Especial de Liquidação e de Custódia) is the Brazilian interest rate. The Ibovespa is the benchmark index of stocks traded on the B3 Brasil Bolsa Balcão) and lists major companies in the Brazilian capital market.

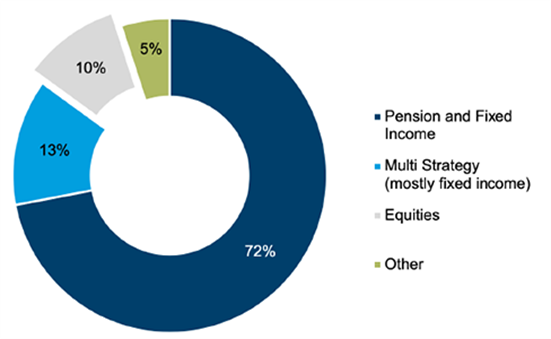

With interest rates at these highs, we do not offer tremendous insight by noting that the country has a small base of retail investors. There has been little reason for investors to buy equities or alternative investments with the average interest rate over the past decade as high as 10%. In fact, less than 1% of Brazilian adults invest in the stock market, a proportion that is miniscule compared with the US equivalent of around 40%. The retail allocation to equities in Brazil is as low as 10%, which is insignificant when compared with the allocation to pension and fixed income, which dominates at 72%.

Source: XP Inc. Institutional Presentation, as of 31 May 2020

However, the observation that is particularly compelling to our team is the impact of Brazil’s monetary policy committee, which has been cutting these high interest rates in a bid to stimulate a sluggish economy over the past few years. In conjunction with advances in key reforms and adjustments, the Brazilian economy is once again coming to life, notwithstanding recent concerns around the coronavirus. Monetary stimulus has provided a tailwind for consumption as the cost of borrowing has fallen; for economic activity as the cost of doing business has decreased; and for the asset management industry as investors have sought higher-yielding returns in a low-rate environment.

Consumer spending accounts for about two-thirds of GDP in Brazil, and therefore the impact of lower rates can be a significant driver of the economy. At the turn of the year the figures for credit and lending were growing very fast, especially for households, and the retail sector was no exception.

As bonds begin to mature, we are likely to see a trend of forced buyers of equities, given that the SELIC has dropped significantly, to an all-time low of 2.25%. It is worth noting that the last time we saw an approximately 10% rate cut in Brazil – from 19.75% in Q2 2005 to 8.75% in Q4 2009 –we witnessed the retail equity allocation reach 25%1. This time we wouldn’t be surprised if we surpassed that figure.

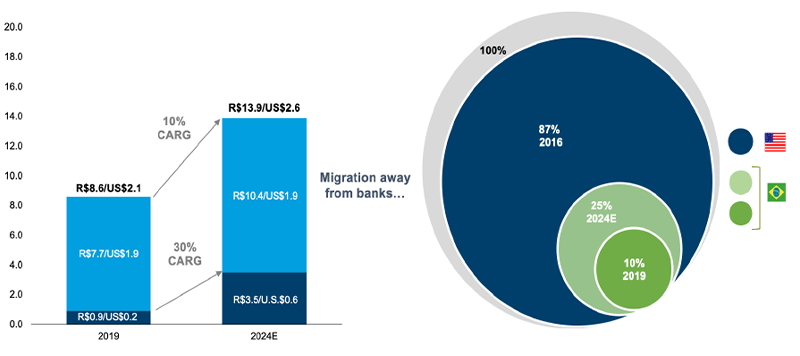

Brazil is home to the largest asset management industry in Latin America, valued at R$8.6 trillion ($2.1 trillion) as of 31 December 2019 and growing at an impressive 14.5% over the past five years. While penetration of the industry is certainly high relative to the region, at 74% of GDP compared with the likes of Chile at 22% or Mexico at 10%, it is still low versus the global standard (the US is at approximately 120%), which means there is certainly opportunity for growth. Furthermore, Brazil’s savings pool from individuals was close to R$800 billion ($199 billion) in 2019, equivalent to 16% of total assets under management (the U. is at approximately 10%), which is ripe for migration to investments2.

Looking more closely at the financial services industry in Brazil, it has historically been defined by its oligopolistic structure, with high levels of regulation and a high degree of informality. The concentration within the asset management industry specifically is no different, with the big five banks – Itaú, Bradesco, Santander, Banco do Brasil and Caixa – controlling approximately 80% of assets under management within the country3. This concentration in Brazil has resulted in limited competition, higher prices and a limited choice of products and services. Furthermore, the services offered are often exclusively proprietary, not tailored to clients’ needs, and simply fail to maximise client returns.

We believe changes to this financial services structure are long overdue, and the falling rate environment, coupled with heightened deregulation efforts by the Brazilian administration, is a key catalyst. Such measures are crucial for a country like Brazil, which has been known for its maze of bureaucracy and unstable monetary policies, in trying to achieve its full potential. Furthermore, technological adoption is the final piece of the puzzle to unlock both growth potential and opportunities.

What does this perfect storm of lower interest rates, increased retail participation, and structural change of the financial services industry mean for stock pickers like ourselves? While the consideration of top-down themes is vital to assess the success of bottom-up stock stories, it is imperative that we find quality businesses to best participate in this thematic observation. In our view, the gates are now opened to online brokers who are changing the competitive dynamic of the industry and democratising access to investment products by providing a platform that enables Brazilians to access independent managers and third-party funds.

Moreover, technological innovations mean platforms are easier to use, with better self-service tools and, importantly, lower investment requirements and fees. These factors enable new entrants to develop a more attractive offering and gain market share in a fast-growing area. Estimates suggest that online brokers could gain market share of between 30%-40% by 2025, up from approximately 10% today4.

Source: XP Inc. Institutional Presentation, as of 31 May 2020. 2019 values reflect currency conversion as of 31 December 2019

A handful of online brokers have already begun to gather significant scale by taking share from incumbent banks. Furthermore, the recent pandemic has accelerated themes around platform companies such as digital brokerage (the same can be said for e-commerce, payments, education etc). By providing bridge loans or access to cheaper financing, as they have recently, these companies may accelerate their long-term growth further as they create or strengthen ties with customers. Identifying those companies with strong open platforms, competitive positions, superior scale and established IFA networks will be the key to harnessing sustainable revenues and earnings growth over the long term.

Further supporting online brokerage, we foresee substantial inflows into the Brazilian equity market as the untapped savings pool seeks more attractive returns in the context of the lower interest rate environment. Some estimates put this close to R$91 billion ($17 billion over the next five years, with conservative estimates expecting the equity allocation to reach 25% of assets under management by 2025, against a current level of approximately 10%5. This opportunity should enable online brokers to grow at faster rates than the industry, and lead to a change in the highly concentrated nature of Brazilian asset management, particularly for those entrepreneurially driven companies that have technology and innovation in their DNA, allowing them to best capitalise on the disruption.

There’s no question this is also an exciting time to be a stock picker in Brazil – IPOs were up 66% in 2019, bucking the trend in global IPO listings which fell by 17% in the same period6. We are seeing increased competition between local and foreign exchanges, such as the Nasdaq, to host these new listings. As the depth and quality of the universe expands, the importance of active management amid such dynamics comes into full focus, and Brazil becomes the playing field for stock pickers like us to differentiate themselves even further.