The textiles industry is one of the most pollutive in the world, emitting more CO2 than aviation and shipping combined. But a leading sports firm is showing one way the sector can embrace radical change

I love shopping for clothes – I admit it. But increasingly, my shopping is tinged with guilt. I am now much more aware of the terrible environmental impact that comes with fashion, with the textiles industry one of the most pollutive in the world. Around 100 billion apparel items are sold per year, which is a circa 50% increase versus 2006.1 This is in large part due to the rise of “fast fashion” – ie cheap, high-fashion items. In fact, the industry now emits more CO2 than the aviation and shipping industries combined, and uses 79 billion m3 of fresh water a year while causing around 20% of industrial water pollution.

But unfortunately, very little of what the industry produces is recycled and reused, with the majority of items ending up in landfill or incinerated within a year of production.2 Indeed, according to the Ellen Macarthur foundation, the global fashion industry produces about 53 million tonnes of fibre a year, of which more than 70% ends up in landfills or on bonfires. Less than 1% is reused to make new clothes.3

This raised awareness has changed my consumption patterns – I now buy fewer but higher-quality items. In addition, I have changed my negative view of buying second-hand clothing and now happily scour for bargains either through online platforms or local charity shops. And it looks like I’m not alone: 70% of women either have, or are now open to, shopping second-hand up from 45% in 2016.4 As a result, rental and resale fashion platforms are seeing strong growth. In the Threadneedle Global Sustainable Global Equity strategy we own one such resale platform, Mercari, which has seen accelerated growth over the past year in its two key markets of Japan and US, with both users and engagement on its platform increasing.

In fact, consumers are increasingly prioritising sustainability, which is starting to influence the way they shop. Nearly 2.5x more consumers plan to shift their spend to sustainable brands.5 At the same time, regulation around building a more circular economy is rising too, such as the EU Circular Economy Action plan which aims to shift production and consumption from the linear “Take, Make, Dispose” model to more circular use of products and materials.6

Adidas has been a core holding since the inception of the Threadneedle Global Sustainable Equity strategy. Its production and promotion of technical sports performance products contributes positively to our social theme of “Good Health and Wellbeing”.

But if we own a textile company, we also want its products to not have a detrimental impact on the environment. Fitness wear is generally worn more frequently and retained for longer than high-fashion items. In addition, Adidas is a sustainable leader in the industry. At its Capital Markets day in March, sustainability was once again front and centre of its agenda. It detailed its innovation around making its products more circular and sustainable and highlighted its target to have nine out of 10 of its articles environmentally sustainable by 2025 using a “Three-loop” strategy7:

- Recycled loop Sourcing recycled raw materials from outside of its own products, namely 100% recycled polyester or Parley ocean plastic waste (upcycled plastic waste collected on shorelines and coastal areas).

- Circular loop Producing products that can then be recycled and remade into new Adidas products – “made to be remade”. It has launched an Ultraboost trainer that can be returned, recycled and subsequently remade into a new pair, with the aim to expand this concept to more franchises and categories overtime.

- Regenerative loop Where products cannot fit into the above categories, Adidas aims to make these products from natural materials that can biodegrade.

Management has in fact set a target for 100% of its products to use only recycled polyester by 2024 aided by the introduction of its sustainable fabrics. All of which sounds positive, but we wanted to see first-hand how sustainability was embedded into the company’s marketing and products on the shop floor.

So, more than a year since our last visit we revisited the Adidas flagship store on Oxford Street, London.

Adidas has improved the integration of sustainability across its product ranges. Before, “green” ranges were showcased separately and in very limited parts of the store. Today, recycled materials are evident across all their ranges throughout the store.

Adidas uses two sustainable materials in its ranges, which are clearly marked (via a label) on different apparel items and trainers:

- Primeblue This is a high-performance yarn made with at least 50% Parley ocean plastic.

- Primegreen This is a series of high-performance materials that are made from recycled ingredients.

Rummaging through men’s, women’s and children’s apparel and trainers, these products made up a substantial percentage of each range. This is a huge advance from a year ago.

Adidas also aims to implement sustainability innovation at scale to make its most popular products its most sustainable. This was on display upon entering the flagship London store where you are greeted with its new “green” Stan Smith selection, one of Adidas’s most iconic trainer franchises which are now made from either Primeblue or Primegreen materials. It also showcased an industry first: a Stan Smith made using Mylo, a mushroom-based material that performs like leather but is biodegradable.

Another in-store service is the “Sneaker services” repair station. This allows customers to repair their trainers, preventing early and unnecessary disposal. Extending the life of a garment by just nine months reduces its environmental impact by an impressive 20%-30%.8

There was also evidence of progress in targeting our social outcome of “Good health and Wellbeing”:

- Expanding sizing in apparel ranges Previously there was a separate section for plus sizes. This has now been replaced with expanded sizing integrated across all ranges as well as the use of plus-size dummies to model clothes for both women’s and men’s ranges. This helps promote inclusion in sport and exercise.

- Greater focus and dedicated innovation around women’s training Adidas has increased investment in women’s training ranges. This was evident in-store from the impressive technical items in the women’s Terrex outdoor range to displays of its exciting new women’s Tennis range.

Digital is another key area of investment for the firm, and the integration of digital and sustainability was on display in the store. For example, there were photo booths where you can take and share your picture and environmental pledge with the online Adidas community.

Overall, we walked away confident that Adidas might achieve its corporate mission: “Through sport we have the power to change lives. By striving to expand the limits of human possibilities, to include and unite all people in sport and to create a more sustainable world”.9

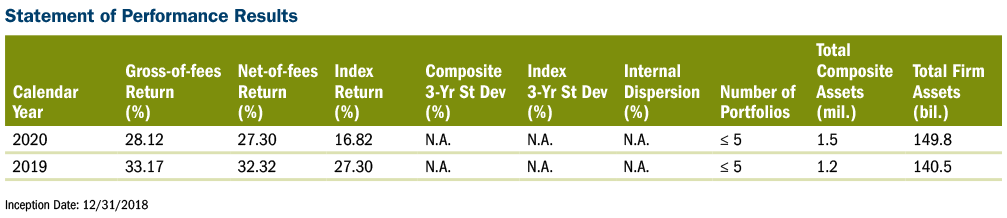

Threadneedle Global Sustainable Equity Composite

GIPS Report: Columbia Threadneedle Investments EMEA APAC

Reporting Currency: USD

1. Columbia Threadneedle Investments EMEA APAC ‘the Firm’

claims compliance with the Global Investment Performance

Standards (GIPS®) and has prepared and presented this report

in compliance with the GIPS Standards. Columbia Threadneedle

Investments EMEA APAC has been independently verified by Ernst

& Young LLP for the periods 1st January 2000 to 31st December

2018. The verification reports are available upon request. A firm

that claims compliance with the GIPS standards must establish

policies and procedures for complying with all the applicable

requirements of the GIPS standards. Verification provides

assurance on whether the firm’s policies and procedures related

to composite and pooled fund maintenance, as well as the

calculation, presentation, and distribution of performance, have

been designed in compliance with the GIPS standards and have

been implemented on a firm-wide basis. Verification does not

provide assurance on the accuracy of any specific performance

report. GIPS® is a registered trademark of CFA Institute. CFA

Institute does not endorse or promote this organization, nor does

it warrant the accuracy or quality of the content contained herein.

2. The ‘Firm’ is defined as all portfolios managed by Columbia

Threadneedle Investments EMEA APAC (prior to 1 January 2021,

the firm was known as Threadneedle Asset Management) which

includes Threadneedle Asset Management Limited, (TAML),

Threadneedle International Limited, (TINTL), Threadneedle

Investments Singapore (Pte.) Limited, (TIS), and Threadneedle

Management Luxembourg S.A. (TMLSA), excluding directly

invested property portfolios. The firm definition was expanded in

2015 to include portfolios managed by then newly established

affiliates of Threadneedle Asset Management in Singapore. TAML

& TINTL are authorised and regulated in the UK by the Financial

Conduct Authority (FCA). TINTL is also registered as an investment

adviser with the U.S. Securities and Exchange Commission and

as a Commodities Trading Advisor with the U.S. Commodity

Futures Trading Commission. TIS is regulated in Singapore by

the Monetary Authority of Singapore. TMLSA is authorised and

regulated in Luxembourg by the Commission de Surveillance du

Secteur Financier (CSSF). On 1 July 2020, Threadneedle Asset

Management Malaysia Sdn. Bhd (TAMM) was removed from the

firm. Columbia Threadneedle Investments is the global brand

name of the Columbia and Threadneedle group of companies.

Beginning 30 March 2015, the Columbia and Threadneedle

group of companies, which includes multiple separate and

distinct GIPS-compliant firms, began using the global offering

brand Columbia Threadneedle Investments.

3. A concentrated global equity strategy with a focus on high

quality companies that seeks to deliver both positive sustainable

outcomes, in accordance with the UN Sustainable Development

Goals (SDGs), and superior financial returns. The composite was

created November 30, 2018.

4. The portfolio returns used in composites are calculated

using daily authorised global close valuations with cash flows

at start of the day. Composite returns are calculated by using

underlying portfolio beginning of period weights and monthly

returns. Periodic returns are geometrically linked to produce

longer period returns. Gross of fee returns are presented before

management and custodian fees but after the deduction of

trading expenses. Returns are gross of withholding tax. Net of

fee returns are calculated by deducting the representative fee

from the monthly gross return. Policies for valuing investments,

calculating performance, and preparing GIPS Reports, as well as

the list of composite descriptions, list of pooled fund descriptions

for limited distribution pooled funds, and the list of broad

distribution pooled funds are available upon request.

5. The dispersion of annual returns is measured by the equal

weighted standard deviation of portfolio returns represented

within the composite for the full year. Dispersion is only shown

in instances where there are six or more portfolios throughout

the entire reporting period. The Standard Deviation will not be

presented unless there is 36 months of monthly return data

available.

6. The three year annualised ex-post standard deviation

measures the variability of the gross-of-fees composite and

benchmark returns over the preceding 36 month period.

7. The following fee schedule represents the current representative

fee schedule for institutional clients seeking investment

management services in the designated strategy: 0.65% per annum. Gross of fee performance information does not reflect

the deduction of management fees. The following statement

demonstrates, with a hypothetical example, the compound effect

fees have on investment return: If a portfolio’s annual rate of

return is 10% for 5 years and the annual management fee is 65

basis points, the gross total 5-year return would be 61.1% and

the 5-year return net of fees would be 55.9%.

8. The MSCI AC World Index is designed to provide a broad

measure of equity-market performance throughout the world

and is comprised of stocks from 23 developed countries and

24 emerging markets. Index returns reflect the reinvestment of

dividends and other earnings and are not covered by the report

of the independent verifiers.

9. Past performance is no guarantee of future results and there is

the possibility of loss of value. There can be no assurance that an

investment objective will be met or that return expectations will

be achieved. Care should be used when comparing these results

to those published by other investment advisers, other investment

vehicles and unmanaged indices due to possible differences in

calculation methods.