An allocation to government bonds within a multi-asset

portfolio has traditionally played a vital role in terms of risk

management and diversification. However, the decadelong

bull era in both government bonds and equities has

led investors to ask whether this assumption is still valid.

Additionally, near-zero yields across the globe bring into

question the cost associated with this diversification benefit.

Bonds1 are usually included within a strategic asset allocation (SAA) of a multi-asset

portfolio for two main reasons:

- Income: They provide a stable source of income in terms of coupon payments, along with a capital cushion in a rising yield environment. For investors with explicit liabilities, this income stream gives bonds an important risk management role. In this paper our focus is on the role of bonds in the return portfolio rather than the liability-hedging portfolio.

- Diversification: In times of crisis, government bonds benefit from the flight-to-quality trade, partly driven by an expectation that central banks will stimulate growth by cutting rates.

The diversification benefit has been brought into question recently and we will analyse

the validity of this hypothesis. Also in this paper, we analyse how government bonds

interact with other asset classes in a multi-asset portfolio and discuss the investor

characteristics which allow us to perform a cost-benefit analysis for including fixed

income allocations within our strategic asset allocation.

Do bonds still diversify?

Over the past decade we have seen both bond prices and risk asset prices rise in

tandem. This behaviour has brought into question the traditional view of government

bonds acting as a diversifier to risk assets and diluted the traditionally negative

correlation between these assets. However, the main question here is what we mean by diversification. When building portfolios for our clients we are conscious

of two types of diversification:

- Average relationship: The extent to which assets have distinct

drivers in scenarios close to the base case. - Tail relationship: The behaviour of assets in downside scenarios,

i.e. crisis periods for the dominant portfolio drivers.

For example, the portfolios we construct for clients have exposure to an

array of different asset classes which have long-term positive expected

returns, and which are not perfectly correlated. As such the long-term

portfolio performance will benefit from different sources of return over time

and will deliver an average return which is diverse, or from a broad set of

asset classes – hence the term “average relationship”.

These portfolios are also designed including asset classes whose role is

to minimise drawdowns when markets enter risk-off periods, behaving as

diversified portfolios in downside periods – hence the term “tail relationship”.

Most joint asset class analyses focus on rolling correlations between

equities and bonds, but this is not an appropriate measure to understand

the tail relationships.

There is little benefit of achieving diversification only during “normal” market

conditions if safe asset classes such as bonds don’t protect the portfolio

when it matters. Measures such as rolling correlations amalgamate all

market conditions and so are not representative of investor preferences.

The best way to challenge this hypothesis is to analyse the behaviour of

equities and bonds in the tail.

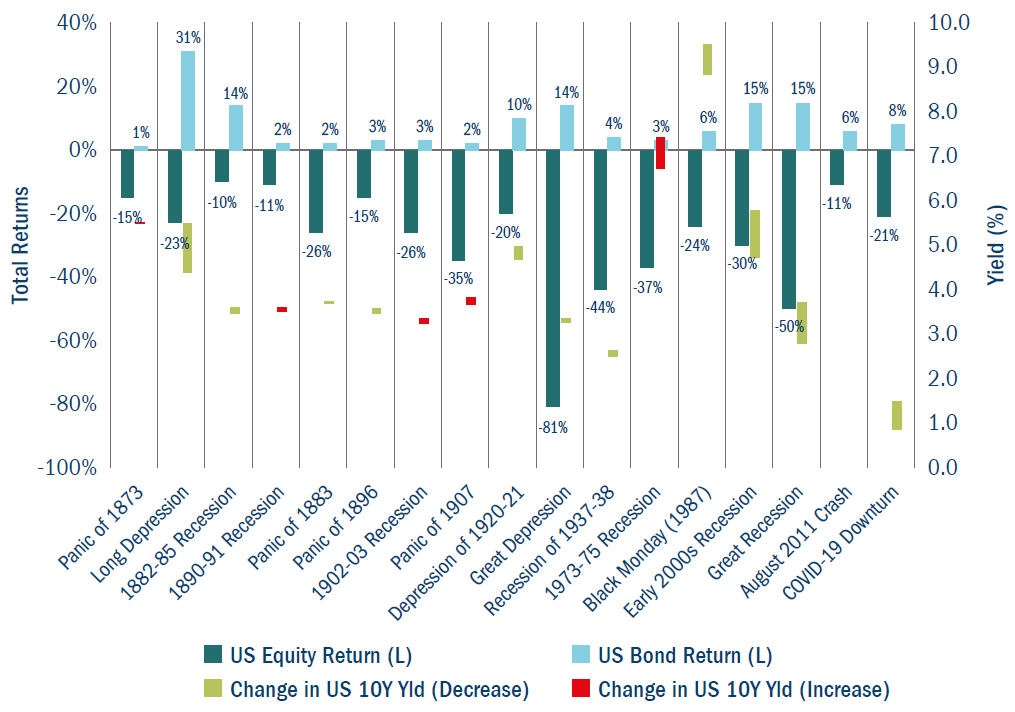

For example, we have used US equity and government bond returns from

1871 onwards to analyse the behaviour of these assets during market

crashes and recessions, identifying 17 periods of crisis which range from

a one-month crash in equities to a four-year recession. Clearly, there is an

element of subjectivity with respect to choosing these periods, but they give

us a decent idea of the interaction between equities and bonds during tail

events. We have only used US data here for two main reasons: the length

and validity of the data is significantly better in the US compared to any

other economies; and global data would implicitly include multiple currency

returns, making it difficult to isolate asset class behaviour.

Figure 1. Relationship in the tail: equity and bond total returns

Source: Stock market data used in “Irrational Exuberance” by Robert J. Shiller and Columbia Threadneedle

Investments. Note: US equity returns are calculated by combining the S&P price and dividend data.

US bond returns are estimated by using the US 10-year yields and assuming a duration of eight years.

Past performance is not a guide to future returns.

As we can see in Figure 1, in every period of an equity market crash

bonds provided a positive return, and this effect does not appear to have

diminished over time. So, an allocation to government bonds does indeed

diversify away some of the risk within equities during tail events – and

even though it might seem that the negative correlation between equities

and bonds has been diluted when observing their average relationship,

the diversification benefit is still present in the tail. Additionally, this tail

relationship has stayed consistent across different regimes as demonstrated

by the 10-year yield at the beginning of each crisis period in Figure 1.

Is the cost of downside diversification justified?

As demonstrated in the previous example, although government bonds

do provide downside diversification in a multi-asset portfolio, we must ask

ourselves if the cost associated with this is worth the benefit. This question

is even more appropriate given the low yields across the globe, leading to

bonds being priced way above their historical average and therefore having

long-term expected returns which are close to the lowest in decades.

Unfortunately, there is not a simple answer to this question, and as with

most questions the true answer is “it depends”.

To illustrate this, let us think about the case of an umbrella on a typical

English day. Assuming there is a certain probability of rain on a given day,

different people will have a different outlook as to whether they need an

umbrella. An individual who is very averse to getting wet (for example, if they

are on their way to a date) is more likely to buy an umbrella, regardless of the

price. In contrast, someone who is not too bothered about getting wet will

perform some sort of cost-benefit analysis on the purchase of the umbrella.

This is not to cast any doubt on the ability or effectiveness of the umbrella

to protect them from getting wet, but more related to the risk aversion of

the individual.

For an investor to determine their allocation to bonds, they need to think

about their preferences and objectives. These can be distilled down to

three main characteristics:

- Time horizon: how long is the investment horizon

- Liquidity/cashflow requirements: is the investor looking to draw a regular income

- Dependency/reliance: is the investor reliant on this pot (e.g. for medical needs or education, etc)?

A combination of these three characteristics helps to situate an investor

on a spectrum from “outcome-driven” to “journey-driven”, which gives

an indication of the appropriate bond allocation within their SAA. For an

investor who requires a smooth performance journey over time, the portfolio

construction process should pay due attention to asset classes that can

provide downside protection via tail relationships. In contrast, for an investor

who is more relaxed about the path and is instead more focused on the

long-term outcome, we should aim to provide a well-diversified positive return

over time and attention should be given to the average relationship.

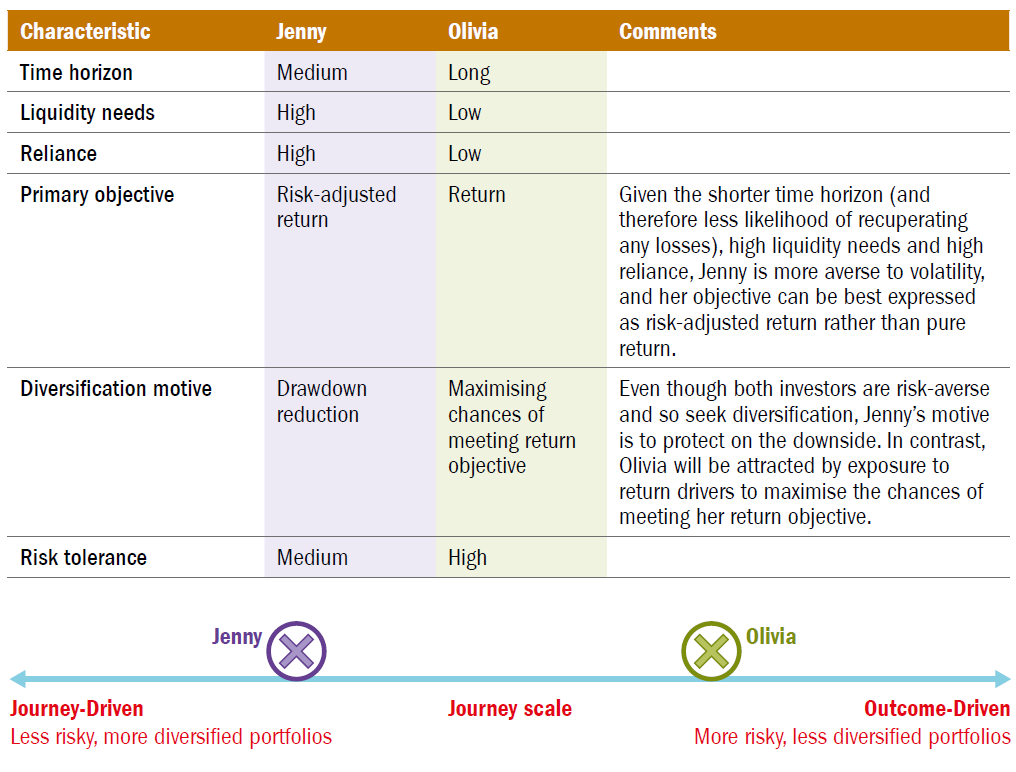

To bring this idea to life, let us imagine two hypothetical investors who

have different characteristics, and discuss how these characteristics have

an impact on their SAA (Figure 2).

Figure 2: Hypothetical investors and their characteristics

Source: Columbia Threadneedle Investments, for illustrative purposes only.

We can see from Figure 2 how the two investors differ in terms of the

three main characteristics of time horizon, liquidity needs and reliance.

These characteristics can then be used to infer some additional features

about these investors, as highlighted in the same figure.

Based on these, we can make some educated judgements about their

investment strategy:

(1) Jenny will likely have a higher allocation to fixed income than

Olivia given the tail relationship.

(2) Jenny will likely have a much lower allocation to real assets than

Olivia due to higher liquidity needs.

(3) Within equities, Jenny will likely be more exposed than Olivia to

developed equities rather than emerging market equities as the

average relationship becomes more important for Olivia.

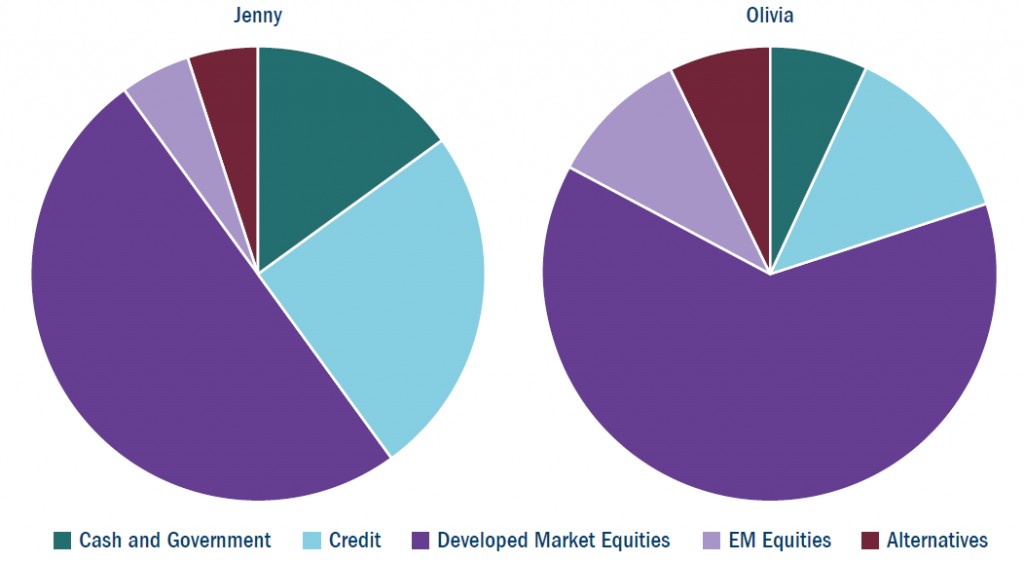

We can then make an informed decision about the broad asset allocation

for the two investors. For example, Jenny is likely to have an SAA which is in

the region of 60% in equities and a modest allocation in government bonds

to make the portfolio more resilient. In contrast, Olivia will be happy to have

an 80% allocation in equities but a lower exposure to government bonds to

maximise the chances of achieving the return target. These allocations can

be thought of as the long-run asset allocation for each investor (Figure 3).

Figure 3: Long-run asset allocation for the two hypothetical investors

Source: Columbia Threadneedle Investments, for illustrative purposes only.

As mentioned, these asset allocations are derived from our long-run capital

market assumptions, which we forecast using long-term risk factors driving

income and growth across asset classes. However, we also need to be

aware of current asset valuations (eg, low yields) and how we expect them

to evolve over the business cycle, which we then translate into asset class

tilts around our long-run SAA.

At Columbia Threadneedle, along with the long-run capital market

assumptions, we also forecast asset class returns which are more informed

by asset valuations and where we are within a business cycle. Both sets

of capital market assumptions are constructed in a way that ensures

consistency across different time horizons.

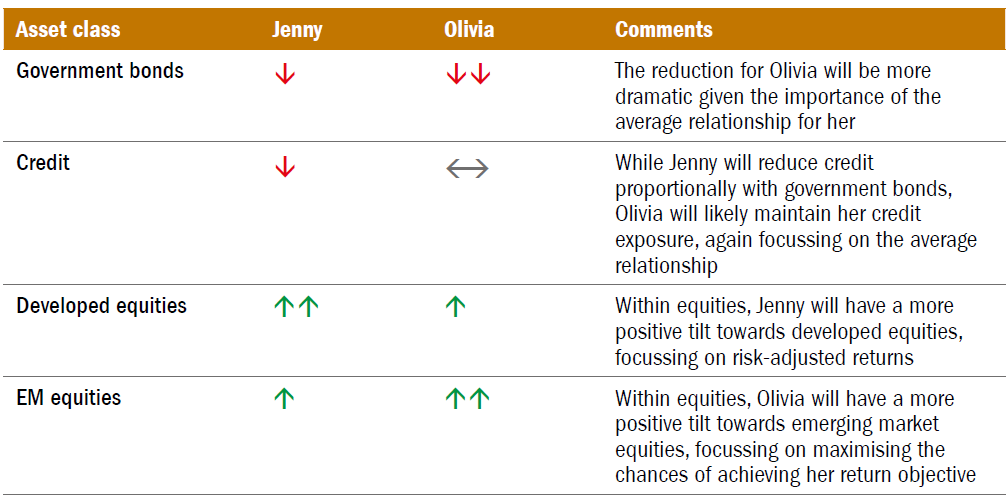

We can then use these “valuation-aware” capital market assumptions to

tilt our long-run SAA to ensure we are aware of current valuations. This is

particularly important with respect to bonds given current yields across the

globe. For instance, while our long-run capital market assumptions assume

bonds are fairly valued, our valuation-aware view expects a degree of mean

reversion – which here means a rise – in yields and are therefore not as bullish. Similarly, our valuation-aware capital market assumptions are more

bullish on equities. All this will lead to the following tilts to the portfolios of

the two investors:

Source: Columbia Threadneedle Investments, for illustrative purposes only.

Summary

There has been much discussion in recent years about the diversification

benefits of bonds and if the cost of this diversification is worth it for

multi-asset investors.

Having analysed two sides of this diversification – the tail relationship and

average relationship – we can see that the tail relationship between equities

and bonds over the past 150 years shows that, even at historically low

yields, bonds have been an excellent tail diversifier in a multi-asset portfolio

during times of crisis. This confirms that government bonds still play a very

important role within multi-asset portfolios across many different regimes.

However, this does not take away from the fact that we need to perform

some level of cost benefit analysis when designing our investment strategy.

Any investment strategy needs to be informed by the investor’s

characteristics, which we have distilled into three main features: time

horizon, liquidity requirements and reliance. These can then be used

to infer the long-run asset allocation for the investor, ensuring the most

optimal portfolio given their preferences on average relationship versus

tail relationship. Additionally, this long-run asset allocation can be tilted to

ensure we are aware of current asset valuations, such as current record low

yields, while remaining consistent with the broad risk stance of the long-run

asset allocation. This process of designing a valuation-aware SAA ensures

that at Columbia Threadneedle we aim to deliver the most optimal journey

for the end-investor without any dramatic asset allocation changes through

the investment horizon.