Investing smarter for the world you want.

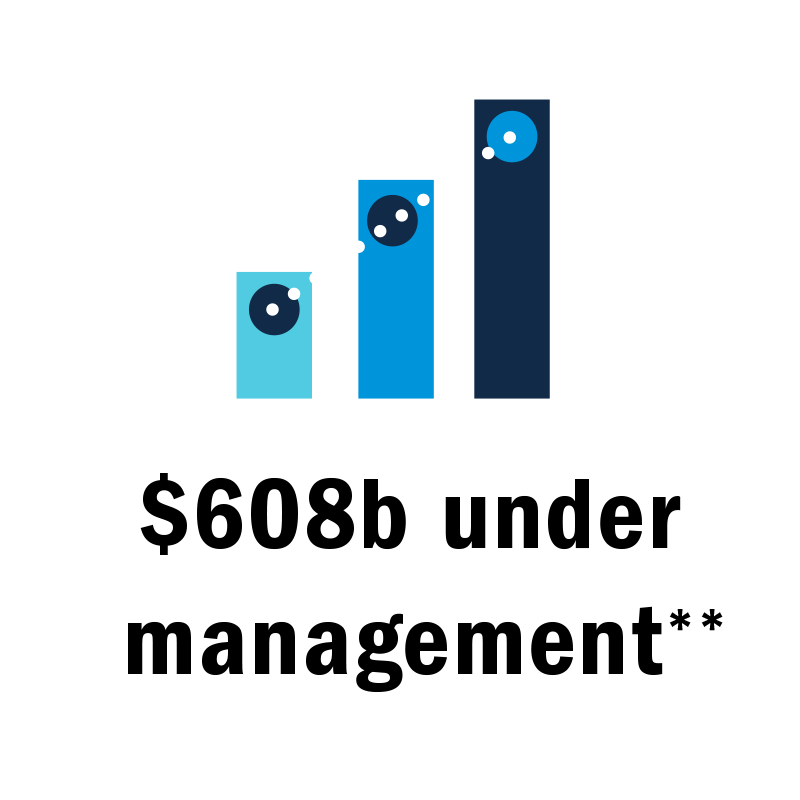

Whatever future you envision, your investments should help make it possible. That’s why we strive to deliver smarter investment opportunities that harness the power of intense research, global perspectives and forward-thinking insights. That’s why millions of people around the world trust us to manage their money.

Our foundation supports your future.

Four essential cornerstones inform our investment solutions.

Global connections lead to deeper perspective.

Intense research informs your investments.

Original, independent research makes for smarter investing. Thanks to next-gen analytics and the collaboration of more than 200 research associates, we’re turning everyday information into forward-thinking solutions.

A philosophy of responsibility guides decision-making.

Our goal is to help you achieve your financial goals without compromising your values, whatever they may be. A responsible ethos guides our business from top to bottom, from everyday interactions to the development of proprietary tools for portfolio managers

Continuous improvement leads to innovation.

Markets don’t stand still, and neither do we. That’s why we’re continually seeking new ways to improve and innovate. Our Consultancy & Oversight team strives to ensure integrity in investing — evidence of our commitment to accountability and progress.

Intelligent insights lead to informed investments

Navigate market trends with our blog.

In Credit Weekly Snapshot – July 2024

How would markets fare under President Trump?

UK Real Estate: Talking points July 2024

Subscribe to keep up with the latest developments.

DISCLOSURES

*Employee data as of 30/09/22

**AUM as of 31/03/23