Simulation is reshaping industries. Take ANSYS1, a business which provides optimisation solutions to markets spanning aerospace, automotive, energy, materials and chemical processing – solutions which become deeply integrated into product design lifecycles. These enable engineers to emulate real world environments and better assess component quality and reliability in increasingly complex products. The result is faster speed-to-market, better decision making and risk mitigation. Having identified the potential of ANSYS early, our portfolios benefitted meaningfully from its rise to a $30 billion company today.2

There are signs that healthcare could provide another wave of simulation demand – especially in drug development:

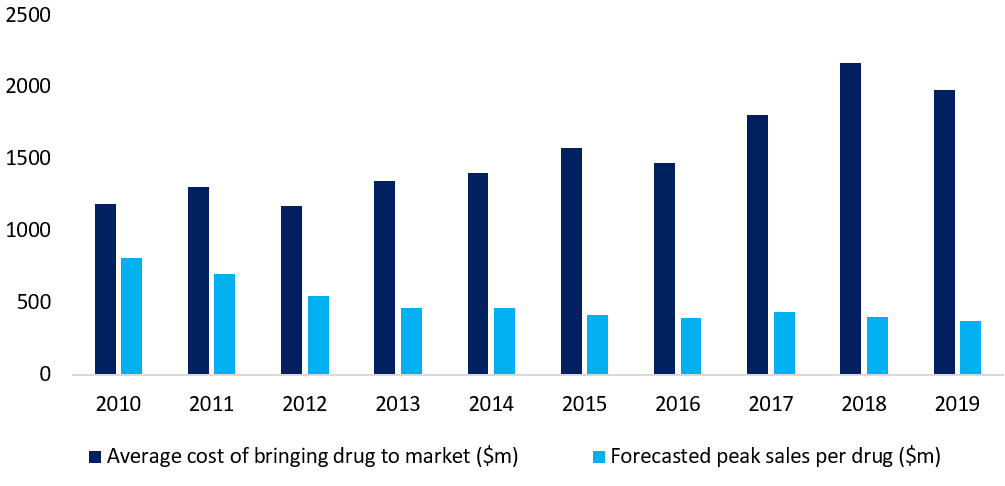

The costs of developing drugs are rising. Deloitte’s same study showed the average cost of bringing a drug to market increased by 67% during the 2010s.

Failure rates remain very high. Two-thirds of drug development programs never deliver an investigational new drug (IND) for clinical trials.

Regulatory requirements are unrelenting. The market for regulatory science and support alone is valued at more than $7 billion, compounding in the low-double digits.

Figure 1: higher costs and lower rewards in drug development

Source: Deloitte, 10 years on: Measuring the return from pharmaceutical innovation, 2020

The case for investment to boost drug development efficiency is therefore compelling; declining returns demand transformational shifts in R&D productivity. So, how can biosimulation help?

A third of all drugs approved by the FDA in 2019 utilised Simcyp, one of Certara’s core biosimulation solutions, up from 13% in 2014.7 Plus, to capitalise on the growing pipeline share of small- and mid-sized biotechs the company has established a comprehensive software, regulatory and market access service for smaller companies with ambitions in drug development which may lack resource or expertise. Between licensing and outsourcing services, we estimate around 60% of Certara’s revenue is generated through biosimulation, with prospects of attractive, durable growth from the prevailing industry trends.

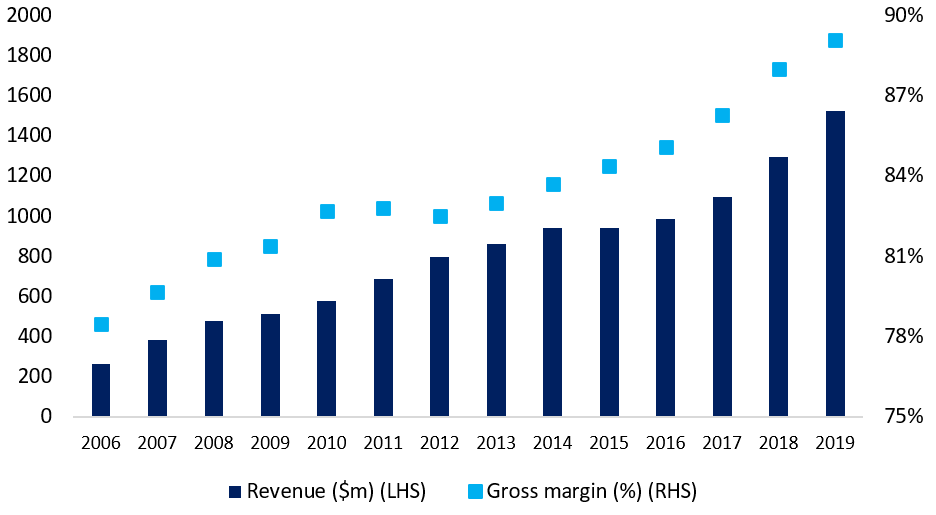

Given the scalability of simulation business models, success means profitability. During 2006, ANSYS generated $264 million in revenue. Fast-forward to 2019 and that figure stood at over $1.5 billion (Figure 2). Gross margins are now touching 90%.8 Meanwhile, Schrödinger’s annualised software revenue is currently around $100 million. The company reports it is beginning to see step-ups in adoption from some of its largest customers, with 16 enrolled in annual contracts worth over $1 million – up from three in 2013.9 And while this business model is not all about the software given its drug development ambitions, gross margins in this division currently stand at 81%.10 With the biosimulation market’s value already exceeding $2 billion, backed by a sustainable, projected annual growth rate of 15%, the company’s roadmap to scale – and consequently, profitability – looks attractively paved.

Figure 2: ANSYS – a model for scalability

Source: Bloomberg, 2021

One of the most frequent lines we hear from healthcare management teams and analysts is that “changing healthcare is hard”. But the advancements of biosimulation may well prove to be one change companies can’t afford to ignore.